Wow. Amazing how the entire world has changed in such a short period of time. It’s times like these that I give thanks for the little things like having a job and staying healthy. It seems like every time I step outside my house, I feel as if I am going to get COVID-19 or the coronavirus. I honestly hope you are all staying safe out there and I sincerely hope we all get through this together. With that being said, even with a pandemic, my dividend stocks keep paying me dividend income. I know my portfolio is small right now, but my goal is to rapidly build it up as fast as possible. It won’t be easy, but it will be worth it. Now, without any further adieu, let’s see how much dividends I earned in March 2020.

Dividend Income

| NO. | STOCK | NAME | DIVIDENDS |

| 1 | EMR | Emerson | $20.00 |

| 2 | GWW | W.W. Grainger | $0.55 |

| 3 | MMM | 3M Company | $1.18 |

| 4 | PFE | Pfizer | $1.27 |

| 5 | XOM | Exxon Mobile | $55.68 |

| $78.68 |

$78.68 is not bad. But! That reflects a large amount of dividends from Exxon Mobile and Emerson, two stocks that I have since sold. However, those dividends have been re-invested into my dividend portfolio, even though I’ve already cashed out the sale of the stocks. I don’t expect my dividends next quarter to be so high, but I’ll take it.

Additionally, I normally receive dividends from more companies, such as JNJ, MCD, and O. However, there was a period of time when I didn’t have any money in my portfolio and I suspect that was the reason why I didn’t earn any dividends from those stocks. That is, I didn’t have any shares on the ex-dividend date for those companies.

Annual Income

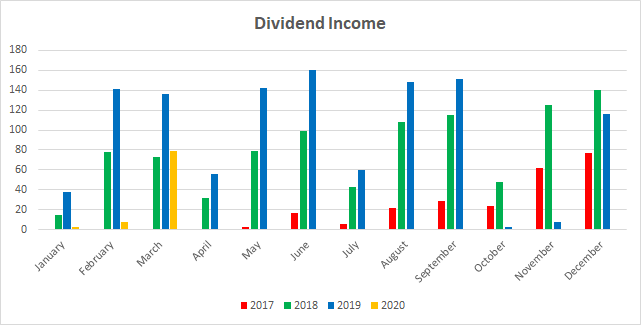

Here is a graphical representation of the dividends earned in March in relation to the dividends earned in previous years:

Here is the raw data:

| MONTH | 2017 | 2018 | 2019 | 2020 | Rate |

| January | $0.00 | $14.93 | $37.54 | $2.22 | -94.09% |

| February | $0.00 | $77.66 | $141.16 | $7.49 | -94.69% |

| March | $0.00 | $72.93 | $136.45 | $78.68 | -42.34% |

| April | $0.41 | $31.47 | $55.39 | ||

| May | $2.85 | $79.33 | $142.69 | ||

| June | $16.89 | $98.51 | $160.47 | ||

| July | $5.99 | $42.32 | $59.68 | ||

| August | $21.95 | $108.44 | $147.73 | ||

| September | $28.72 | $111.15 | $151.66 | ||

| October | $23.21 | $48.09 | $3.00 | ||

| November | $62.11 | $124.92 | $7.18 | ||

| December | $76.51 | $140.24 | $116.51 |

As you can see, I earned a whopping NEGATIVE 42.34% of dividends as compared to last year. Because of the recent drops in the market, I’ve stepped up my efforts to contribute more into my dividend portfolio. My next immediate goal is to cross the $1000 amount invested as soon as possible. From there, I will try to cross $5000 and then finally $10000. Hopefully, by the end of the year, I will have at least $10000 invested in my dividend portfolio. I’m already behind schedule, but I think I can do it.

Forward Annual Dividends

At the time of this writing, my forward annual dividends is $19.66. In my last dividend income report, I indicated that my forward annual dividend income was a whopping $0.00. So, not a bad improvement from last month.

Given the fact that I recently liquidated my dividend portfolio, I have ZERO intention of liquidating this portfolio again any time soon. Of course, life is what happens when you make plans, but I am going to try my very best to hold off selling again for at least another 13 years or so. Now, that doesn’t mean I won’t sell one or two stocks within my portfolio because the company no longer meets my criteria. But I will likely not engage in portfolio liquidation as I did to close on the condo.

My next immediate goal with respect to the forward annual dividends is to get to $50 in dividends per year, followed by breaking the 3-digit mark. Slow and steady right?

Finally, the Dividend Tracker has been updated.

Conclusion

I’m on fire. I increased my monthly contributions from $50 per month to $250 per pay period. Since I get paid twice a month, I am contributing a total of $500 to my dividend portfolio, starting in April. Now, the amount that I contribute may be in flux for the next couple of months. I still haven’t closed on the condo yet and, supposedly, we are closing next month. We will see. There’s a lot happening there, because of the coronavirus, but that’s for another post. After I close on the condo, I plan on increasing my monthly contributions to my portfolio.

What do do you think of this post?

Let me know your thoughts by commenting below.

Congratulations and best of luck on your journey. I like your picks and you should check out Buffett’s thoughts on buying stocks long-term. Lots of great YouTube videos on him discussing buying a “piece of the business”. I rarely sell positions anymore, unless something changed with the fundamentals of the company or if they cut the dividend. I am mostly focused on blue chips with large amounts of cash on hand. Best of luck!

Hey DD, thanks for the comment. I’m a huge fan of warren buffet and I definitely am invested for the long term. Sometimes though life happens, and that causes you to sell, but I’m excited for the future. I just can’t wait!

Dividend Portfolio,

Best of luck getting the portfolio going again. In the grand scheme of things, your timing probably wasn’t that bad. You’ll be able to pick up a lot of names at a steep discount to a few months ago. Slowly but surely you’ll get the portfolio rolling again. I’ll be writing a blog post soon about this article on Fidelity: https://www.fidelity.com/viewpoints/investing-ideas/six-tips

It is a strong proponent of buy-and-hold.

Scott

Scott recently posted…March 2020 Income

I’ll look out for the article. Thanks for the encouragement. I have hope that the future will be bright and the dividends will start rolling again.

Just finished that post. It’s a long one. Let me know what you think.

Scott recently posted…Timing the Market is Hard. But…Here’s How I Do It!

Ok, I’ll check it out now.

Such a great post. Looks like a solid March 2020 keep it up man. Now is a difficult time, and I hope that there will be no loss! I love passive income investment because it has got more advantages compared to disadvantages. Dividends are cool.

Dividends are awesome! Thanks for the encouragement John. I hope you stay safe during these crazy times.